Klarna is an online service launched by Klarna Bank AB. It is a Swedish fintech company that supplies financial services via an online gateway. It includes payments made for online storefronts, post-purchase costs and also helps you to make direct payments.

Klarna partners globally with retailers to create an easy gateway for you to pay on checkout. They also have an application (Klarna App) that allows you to make flexible payments anywhere from all around the world.

Klarna functions on the business model of Buy Now Pay Later. This flexibility offered by Klarna allows you to balance your budget. They have millions of users from all over the world. This is because of the payment plans, which benefit the users during online shopping. They claim, “Try before you buy, or pay over time.”

Apps Like Klarna Available Online

There is no doubt that Klarna is one of the most popular options available for shoppers online who like the Buy Now Pay Later applications for shopping. This app is the best option for people who do not want to pay the total upfront price.

However, all of those addicted to online shopping using various Buy Now Pay Later Sites from the comfort of their own homes must know how many apps like Klarna are available online. Here are a few Klarna alternatives and competitors offering the Buy Now Pay Later option, so you can have a more comprehensive option of getting the best deal from various vendors available online.

1. Sezzle

Sezzle is a public company registered in the industry of traded financial technology having headquarters in Minneapolis, U.S. It also operates in Canada. This company has selected retailers worldwide, especially in the U.S and Canada, offering interest-free installment plans.

Sezzle has been around for some time now. Its popularity has increased over time due to its fast approval process involving soft credit checks on its users.

The Sezzle app works because, firstly, your account gets verified, and you will receive an approval decision afterward. This will allow you to start shopping right away. If Sezzle rejects you or your query gets rejected, there would be no effect on your credit score.

It is the “Buy Now Pay Later Guaranteed Approval App.”

When you use Sezzle, they ask you to pay the first installment at checkout and the remaining two or three installments every two weeks.

Pricing:

Like Klarna, Sezzle has a reward program. People who use Sezzle to pay for purchases can earn Sezzle spend, a reward program to get a credit score through promotions. You can use your spend credit score toward future purchases made with participating merchants.

Sezzle only offers one payment option, which is four payments over six weeks. It does not charge any interest and the only fees it charges are late payment fees. Some financial institutes and banks do not support the Sezzle platform, so they cannot be linked to your account for your installment payments. Currently, American Express and Capital One credit cards are not acceptable payment choices.

2. Afterpay

Afterpay is an Australian-based company in the industry of financial technology. It operates in the United Kingdom, U.S, New Zealand, Australia, and Canada. Afterpay was founded in 2015.

Afterpay is an app like Klarna and shares many similarities. Their business model works on payments for online shopping in four equal installments. Similar to Sezzle, Afterpay allows you to make installments every two weeks. This will help you sort out your payments in plenty of time and give you the freedom to adjust your finances.

The approval and rejection rate by Afterpay is done chiefly on a per-purchase basis. They claim that you must make timely payments to get your chances approved.

They have a massive volume of items available as they have partnered up with more than 12,000 vendors globally. This will present you with an enormous option table of products. With their Buy Now Pay Later Electronics and Appliances category on their Official Website, you can browse and get massive discounts if you buy these products via Afterpay.

Pricing:

It is a complete buy now and pay later app when you need to purchase a product but don’t get the money to spend. This is where Afterpay plays its crucial role, and the only thing you want when you are going shopping is the Afterpay on your mobile phone.

When you make the purchase, you would have to pay the first installment to ship the product, and then you can pay it in 3 extra installments to Afterpay. In total, you have to pay 4 installments, and the key point is that you would have to pay the first installment to bring your product to your home. After that, you can pay the next 3 installments every two weeks.

In addition, it is completely free of interest platform that allows you to shop now and pay later.

3. Affirm

Affirm is another Public company in the industry of financial technology. It has its headquarters in San Francisco, U.S. Affirm has been operating since 2012 and has its significant operations directed as a financial lender.

Talking about apps like Klarna, they offer installment loans for consumers whenever they make an online purchase.

They have such a massive business operation that you might have seen Affirm after purchasing from online stores such as Wayfair, Casper, or Walmart. They have several thousands of retailers with whom they have a partnership (both offline and online).

To get approved at Affirm, you need to have a soft credit check. Other than that, there’s no minimum credit score for qualifying. They claim that an average individual customer using Affirm takes a loan of $750, which that customer pays in total over the period of 9 months with an 18% Annual Percentage Rate.

Affirm’s policies and business model make the customer trust this ‘Buy Now Pay Later’ company and is an excellent alternative to Klarna. With it Buy Now Pay Later Electronics category on their website, it makes it stand out from the rest of the competition.

Pricing:

It is also one of the best Klarna alternatives well-known for buy now and pays later. Unfortunately, the platform is only available for Apple users. It refers to it as a pay over time app which allows you to buy anything and pay in the long-term but with limitations.

First, your credit score should be good enough to borrow money at low interest. The interest of Affirm varies between 0-30% depending on your credit score. Affirm has a partnership with the majority of popular brands, and you can use it everywhere you shop or buy anything. If you are eligible for the firm’s services, you can buy anything and then pay the full monthly installments. Affirm does not charge any hidden cost to you. Everything is just straightforward. In fact, they do not charge you for delay charges.

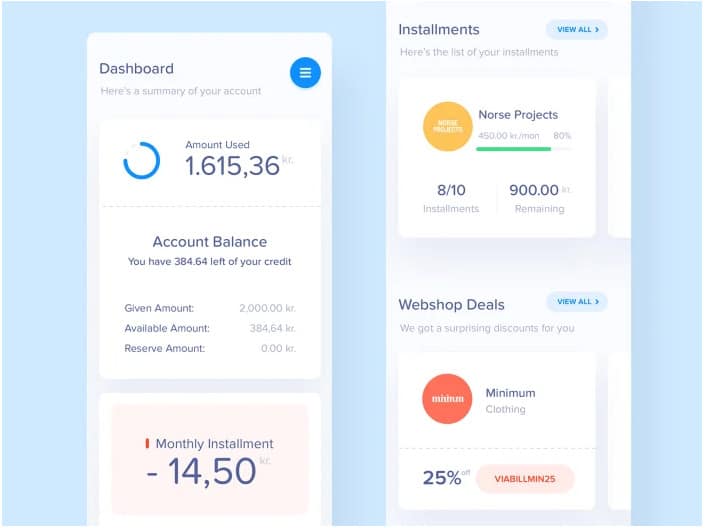

4. ViaBill

ViaBill has been operational since 2014 now. They have made payment plans suitable, flexible, and competitive online payment solutions for online shoppers in Spain, U.S, and Denmark. They have the same payment plan as that of Klarna, where the payment gets split into installments, and you can pay them back interest-free.

They claim that they provide affordable, transparent, and easy-to-understand payment plans via financing to their customers.

ViaBill makes you enter some personal information like your cell number, email ID, credit or debit card number so your request can be approved at checkout. Once your approval is done, you can make four equal monthly installments. The first payment is made as a down payment at the purchase point.

Then ViaBill has gotten you all covered here when it comes to diversity. It has options for payment on over 5,500 websites. ViaBill is an app like Klarna in many ways, although it does not require any credit checks.

Pricing:

VIABILL is also an excellent choice for your if you shop too much. It offers its service in almost all product categories. You can purchase from 1000 online stores, which makes it the best alternative to Klarna. VIABILL’s monthly payment programs work in a different way than the others.

You can pay the total amount of any purchase in four monthly installments, and the interesting fact here is you would have to pay at least 25% of your total purchase amount, and then you can pay the rest of that in installments. VIABILL is a free platform that would not charge any interest or hidden charges.

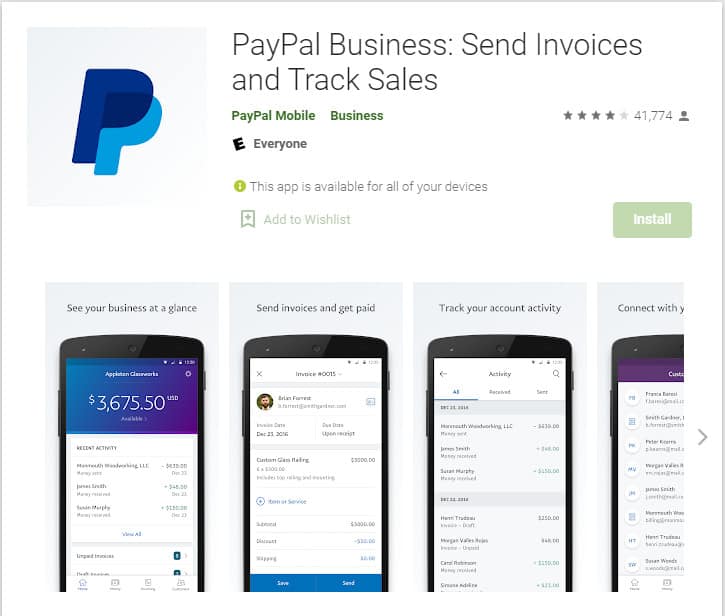

5. PayPal Credit

PayPal Credit was formerly known as Bill Me Later. As we already know about the network spread of PayPal, PayPal Credit has access over Home Depot, USPS, B&H Photo Video, Best Buy, Overstock.com, Liquidation Channel, Jewelry Television, Hotels.com, and Wal-Mart.

Almost everyone nowadays is using PayPal to send or receive payments online. The PayPal Credit is integrated with your PayPal account, providing you with a revolving credit card with a resume credit line.

One thing that PayPal Credit has is the sharp interest rates. This is a turn-off for many people. However, you can utilize the credit line to make online purchases with the liberty to pay the total cost over a specific time (offered/set by PayPal Credit).

Another part of their policy that might make you interested in using PayPal Credit is if you make an online purchase via PayPal Credit worth $99 or higher, there won’t be any interest charge if you pay the total amount in the next six months.

Pricing:

PayPal is the most commonly used and reliable payment service worldwide. If you are not aware of PayPal, it offers its customers the convenience of breaking significant amounts into monthly installments. It also provides you to buy now and pay later options. Once you get the approval of PayPal credit, you are eligible for a number of benefits. For example, you can throw out the interest on your PayPal balance for around six months.

If you pay $99 on any of your purchases, you are eligible for 0% interest on your balance from that payment date. The most exciting thing here is that it renews automatically whenever you spend more than $99.

The core point here is that you can use PayPal credit to buy anything on supported stores and pay for that in monthly installments, a maximum of six months with low-interest charges.

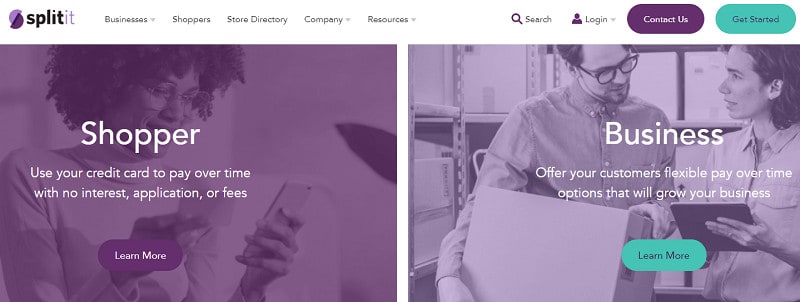

6. Splitit

Another one of the most used Buy Now Pay Later options with no credit check available online is Splitit. They have a broad and extensive E-Commerce network of businesses that offer interest-free monthly based installment payment plans to their clients and customers.

The portion of Splitit that makes it stand out from Klarna is that customers do not have to apply for a brand new credit line or apply for qualification for a new credit card. They merge the existing credit cards of their customers with Splitit to take advantage of the already existing benefits offered by their regular credit cards like Mastercards, Visa credit, or debit cards. For instance, cash-back, mileage, or points.

They claim that by using Splitit, the businesses can have higher conversion rates, customer satisfaction will increase, reduced purchasing barriers, and average tickets will get higher.

Splitit works. You can select the payment option of Splitit at checkout and decide the number of installments you would like to pay the total cost of your purchase. Debit cards have a maximum limit of $400 of investment, while credit cards have no limit. Splitit will automatically cut out the installment from your credit card every month.

Also, one of the best features of Splitit is, it falls under the category of “Buy Now Pay Later No Deposit No Credit Check Instant Approval”. This solely makes it stand out from the rest of the competition.

Pricing:

Splitit is another best choice to split your significant payments into easy payable payments. However, splitit does not have their iOS and Android app, but you can visit their sites to take advantage of splitit. It also does not check your credit score, just log in, and you are done.

To take advantage of its buy now pay later option, you would have to select splitit at your checkout options, and then you can pay in monthly installments. It allows you to choose the installment time on your terms. Splitit is a free platform that does not charge you for anything since there is a 0% interest policy.

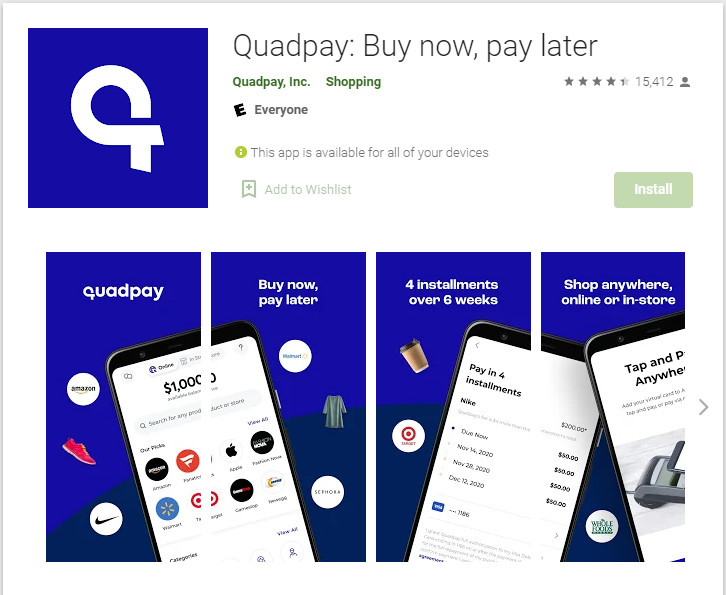

7. Quadpay

When talking about apps like Klarna, Quadpay also runs the race. It is an excellent alternative for Klarna as Zip runs it. It allows online shoppers freedom and flexibility in the Buy Now Pay Later niche.

Quadpay will allow you to make four installments at checkout, with the first installment directly as a down payment. The three payments will be made in installments at the end of each month.

Whenever you make a payment for the purchase you are making via Quadpay, soft credit checks will be made. Based on their fast approval decisions, customers can shop online without any issue or slowness.

Lastly, Quadpay can impact your credit card rating if you fail to pay on time. However, Just like Affirm, one of the the things that not all Buy Now Pay Later Apps or other Apps like Klarna do have is the inclusion of Buy Now Pay Later Electronics. You can go here on Quadpay electronics and check out with the best deals possible.

Lastly, Quadpay can impact your credit card rating if you fail to pay on time.

Pricing:

Quadpay allows users to shop anywhere, including online and offline, and split purchases that fall within a certain price limit into four installments. It does not use hard credit checks and does not report directly to the credit bureaus, so applying for a loan from Quadpay doesn’t affect your credit scores. Quadpay does not charge any interest on any of your purchase amounts. It is a free platform that spread out your payments into four installments over six weeks.

8. Perpay

Perpay helps millions of Americans to make their life’s purchases easier to manage and saves them from the hassle of rent-to-own stores or high interests in credit cards.

They offer a massive range of brands in almost every category you can imagine. They provide sensible financing plans to give their customers access to high-quality products without interest or hidden fees. They cut out small amounts at the end of every month from your credit card automatically to create an easy gateway for the customer to manage their finances.

If you continuously keep on using the Perpay platform, you will see that your spending limit will be increased over time.

When you sign up on Perpay, they ask you a few questions to determine your credit card’s spending limit. The range is set between $500 to $2,500. Afterward, they allow you to go into their marketplace, where many big brands are sitting with hundreds and thousands of products lined up.

Pricing:

Perpay is also an alternative to Klarna. After registering, you will be asked questions about your sopping limit, ranging from$500 to $2000. As Perpay is a free platform, you can browse their marketplace consisting of hundreds of popular brands.

A direct payroll deposit is needed to make your purchase, and the installments will be deducted from your future paychecks. This results in you do not have to worry about missed payments.

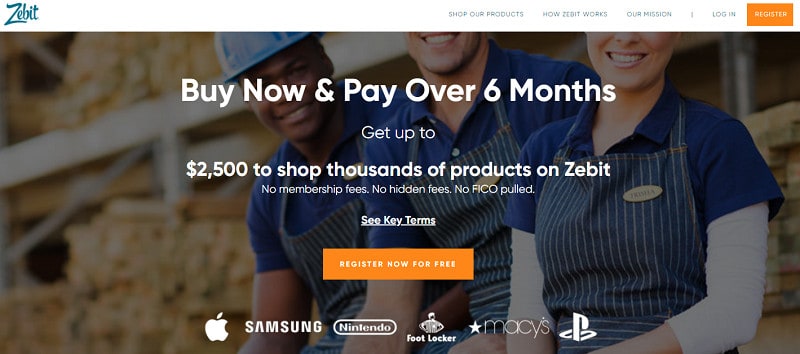

9. Zebit

One of the great platforms that popup out of all the listed applications when we discuss apps like Klarna is ‘Zebit.’ They have a mission of making online shopping comprehensive and all-embracing for everyone. The customers’ financial history and credit history do not matter to Zebit.

They allow you to buy your favorite brands and give you the freedom to pay in installments without any hidden charges.

Zebit holds more than 3 million users. When you initially sign up to Zebit, they give you the chance to take out a $2,500 credit which is interest-free. To qualify for this, you must be over almost 18 years old and have active employment or retirement benefits.

They have never charged any loyal users with any hidden fees, membership fees, and interest charges.

Pricing:

Zebit is a platform with more than 3 million users. It provides you the chance to take out a $2500 interest-free credit which should be more than enough for your shopping. To be entitled, you must be over 18 years old. Zebit is a free platform which means they do not charge interest and membership fees.

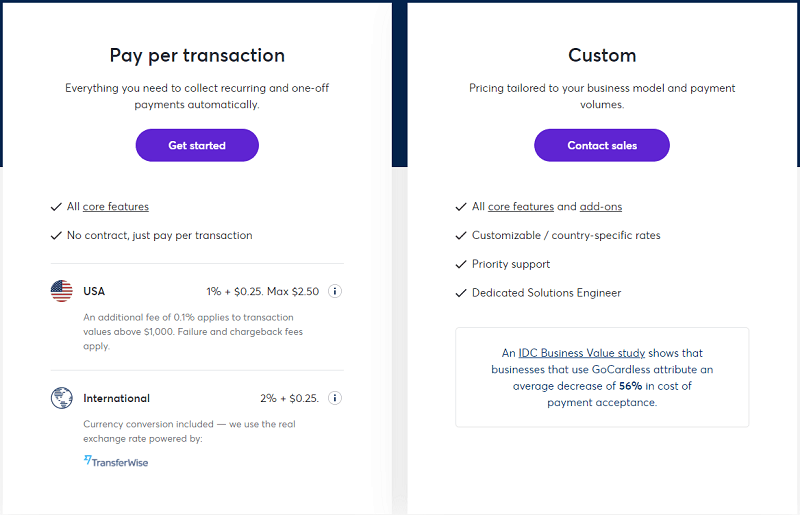

10. GoCardless

GoCardless is another alternative in the list of apps like Klarna. They have a massive network of over 30 of the world’s largest economies. Their clients range from small businesses to huge brands like TripAdvisor, The Guardian, and DocuSign.

GoCardless can integrate with over 200+ partners, particularly Salesforce Billing, Recurly, Yaypay, and Zuora. They collect payments from customers via their direct debit cards. They claim to process almost $15B+ payments across eight countries every year. Countries include the U.S, the U.K, European Union, Australia, New Zealand, Denmark, Sweden, and Canada.

They can help you improve your payment volume, provide smooth operations for customers, and automate administrative tasks to help save time and reduce costs.

Pricing:

GoCardless is another best alternative to Klarna. The platform does not charge any setup costs or hidden fees as it has three different packages currently available. GoCardless pricing starts at $0.01 per feature per month. There is also a free version available. It offers a free trial with no monthly fees and works on a pay per transaction basis.

Frequently Asked Questions

- PayPal Credit

- Affirm

- Sezzle

- Klarna

- Quad Pay

- Zip Pay

- AfterPay

- ViaBill

- Zebit

- GoCardless

Klarna has a much wider coverage of categories in comparison to QuadPay. Klarna covers Home & Garden, Computer Electronics, Technology, Lifestyle, E-commerce, Shopping, and 15+ other categories. In contrast, QuadPay lacks in all of these categories.

Both of these companies are competitors of one another and only differ in the payment options. Affirm allows you to spread your payments over a fixed period from 3 to 36 months, on the other hand Klarna offers 4 separate payments option if you pay the first installment in the first 30 days.

Klarna does perform a soft credit check as a part of their application process. Nevertheless, this will not knock down your credit score in anyway, or even be portrayed on your credit report as a hard inquiry.

Amazon does supports Klarna. You just need to search for Amazon on your Klarna app and from there you can start adding products/items in your cart. This way you can shop on Amazon via Klarna.

Well, Klarna claims that, “Each purchase is subject to an individual availability assessment.” So, dissimilar to your conventional credit contracts, Klarna offers ‘No set Credit limit’.

Whenever you make a purchase on Klarna, there is a soft credit check which is performed to determine the eligibility for every transaction. This will not impact your credit score whatsoever. Additionally, its visibility is only limited to you.

Final Say

These apps like Klarna and Klarna itself can help you in many ways to make payments via installments for the products you cannot buy right away. However, you must be efficient and think appropriately before purchasing products through these services. Who knows that you might fall into a vicious debt cycle and destroy your credit score.

So, beware and stay sharp.